Day Trading for Beginners A Comprehensive Guide to Starting Your Journey in the Stock Market

Introduction to Day Trading

Day Trading for Beginners is the practice of buying and selling financial instruments, such as stocks, options, or cryptocurrencies, within a single trading day. The goal is to profit from short-term price movements, rather than holding investments for the long term. This style of trading appeals to those looking for quick returns and an active approach to the markets.

For beginners, day trading can seem intimidating due to its fast pace, the use of leverage, and the potential for significant financial risk. However, with proper education, strategy, and discipline, it is possible to start day trading safely and effectively.

Understanding the fundamentals of Day Trading for Beginners, including market mechanics, trading strategies, risk management, and psychology, is essential for beginners. A well-informed approach can help mitigate risks while maximizing potential opportunities.

Key Concepts Every Beginner Should Know

Before placing your first Day Trading for Beginners, it’s important to understand some key concepts in day trading. One of the most important is liquidity, which refers to how easily an asset can be bought or sold without affecting its price. Highly liquid stocks or assets are generally preferred for day trading.

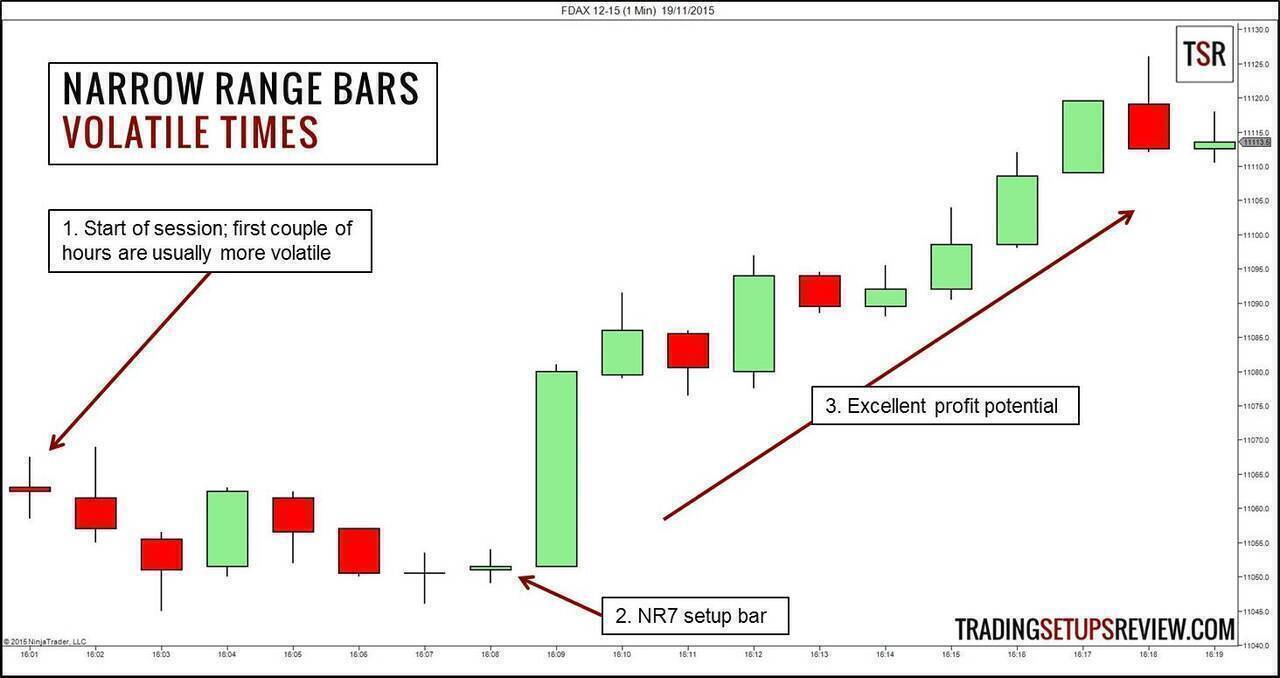

Volatility is another crucial concept. It measures how much an asset’s price fluctuates over a given period. Beginners often start with volatile markets because they provide more trading opportunities, but high volatility also increases risk.

Other essential concepts include bid-ask spreads, leverage, margin accounts, and trading fees. Understanding these terms helps beginners navigate the market with confidence and avoid costly mistakes.

Types of Day Trading Strategies

Day traders employ a variety of strategies to capitalize on short-term market movements. One common approach is scalping, which involves making dozens of small trades throughout the day to profit from minimal price changes. This strategy requires quick decision-Day Trading for Beginners and a strict risk management plan.

Another strategy is momentum trading. Traders using this method look for stocks or assets experiencing significant movement in price and volume, then enter trades in the direction of the momentum. It’s effective in fast-moving markets but requires careful monitoring and timely exits.

Swing trading, while technically longer-term than pure day trading, can also be adapted for beginners. It focuses on capturing price swings within a few hours or days and often relies on technical indicators, charts, and trend analysis to make informed decisions.

Tools and Platforms Day Trading for Beginners

Having the right tools is crucial for Day Trading for Beginners success. Most beginners start with a reliable trading platform or brokerage account that offers real-time data, charting tools, and low fees. Platforms like TD Ameritrade, Interactive Brokers, or Robinhood are popular choices, but it’s important to research and compare features.

Technical analysis tools, such as moving averages, RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), and Bollinger Bands, are commonly used by day traders to identify entry and exit points. Beginners should spend time learning how to read charts and interpret indicators.

Additionally, news feeds, economic calendars, and market scanners help traders stay informed about price-moving events. A well-equipped trading workstation, whether desktop or mobile, allows beginners to react quickly and make informed decisions.

Risk Management for Beginners

Risk management is the cornerstone of successful day trading, especially for beginners. It involves setting stop-loss orders to limit potential losses, determining position size, and managing leverage to prevent large drawdowns.

A common rule of thumb is to risk no more than 1–2% of your Day Trading for Beginners capital on a single trade. This helps protect your account from significant losses while allowing room to learn and refine strategies.

Diversification, although less relevant in day trading than long-term investing, can also reduce risk. Beginners may trade multiple assets or sectors to avoid being overly exposed to one market movement.

Common Mistakes Beginners Make

Many Day Trading for Beginners make similar mistakes when starting out in day trading. Overtrading is a frequent issue—entering too many trades without a clear strategy often leads to losses. Patience and discipline are essential to avoid impulsive decisions.

Ignoring risk management rules is another common error. Beginners sometimes chase profits without considering potential losses, leading to significant financial setbacks. Consistently applying stop-loss orders and position sizing can prevent this.

Finally, failing to educate oneself is a critical mistake. Day trading requires ongoing learning, analysis, and adaptation. Relying on tips or unverified sources instead of building knowledge and experience increases the likelihood of mistakes and financial loss.

Developing a Trading Plan

A well-structured trading plan is essential for Day Trading for Beginners to succeed in day trading. It outlines entry and exit criteria, risk tolerance, position sizes, and daily trading goals. Having a plan reduces emotional decision-making and provides a roadmap for consistent execution.

Backtesting strategies using historical data can help beginners refine their approach before risking real capital. Simulation accounts or paper trading allow new traders to practice techniques and learn from mistakes without financial consequences.

Regular review and adjustment of the trading plan are also important. Market conditions, personal goals, and experience evolve over time, and a flexible plan ensures continued growth and adaptability.

Psychological Aspects of Day Trading

The psychological component of Day Trading for Beginners is often overlooked but is critical for success. Emotions such as fear, greed, and frustration can negatively impact decision-making. Beginners must cultivate discipline, patience, and emotional resilience to navigate market volatility.

Mindfulness techniques, journaling trades, and setting realistic expectations can help manage stress and improve focus. Treating trading as a skill rather than a gambling activity encourages a methodical and analytical approach.

Maintaining a healthy balance between trading and personal life is also essential. Burnout, stress, and fatigue can impair judgment and lead to mistakes. Beginners should prioritize mental well-being alongside financial goals.

Resources for Learning and Improvement

Day Trading for Beginners have access to numerous resources to accelerate their day trading education. Books, online courses, webinars, and trading forums provide valuable insights into strategies, market analysis, and risk management.

Mentorship programs or trading communities offer support and guidance. Learning from experienced traders, sharing experiences, and receiving feedback can shorten the learning curve and improve decision-making.

Additionally, keeping a trading journal is invaluable. Recording trade setups, outcomes, and emotional responses allows beginners to identify patterns, strengths, and areas for improvement, ultimately enhancing long-term success.

Conclusion

Day trading for beginners can be both exciting and challenging. By understanding key concepts, learning essential strategies, using the right tools, and applying strict risk management, beginners can approach the markets with confidence.

Success in day trading requires discipline, patience, and continuous education. While the potential for profit is high, so is the risk, making careful planning and realistic expectations crucial.

For those willing to invest time and effort, day trading offers a unique opportunity to actively engage with the financial markets, develop analytical skills, and potentially achieve financial growth. Starting small, learning consistently, and practicing discipline are the keys to building a sustainable and rewarding day trading journey.